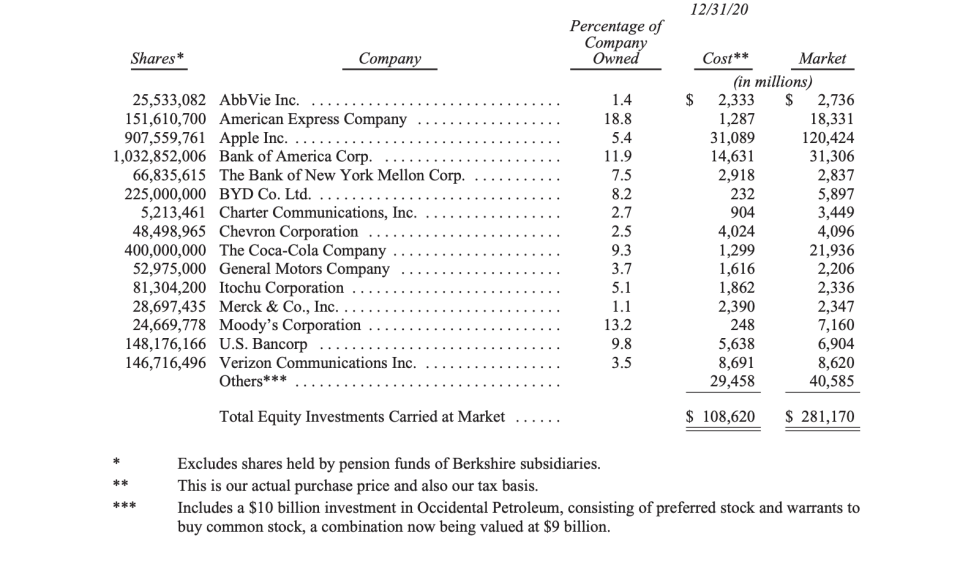

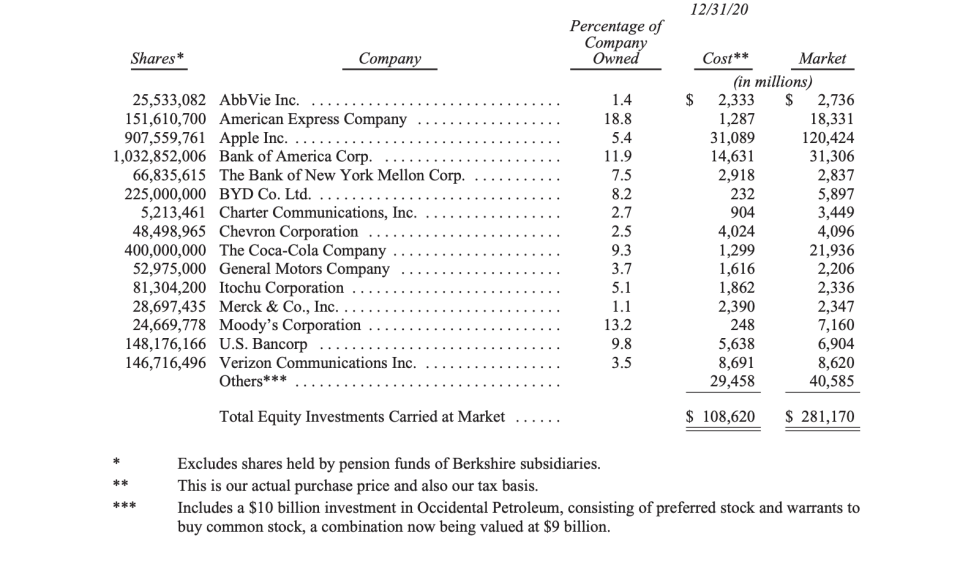

Warren Buffett’s famed stock portfolio has grown to a market value of $281.17 billion at the end of 2020, with a cumulative actual price for the entire portfolio of $108.62 billion.

Last year, Berkshire earned $4.9 billion in realized capital gains and $26.7 billion in net unrealized gains from its stock holdings.

In Buffett’s annual letter to Berkshire Hathaway (BRK-A, BRK-B) shareholders, the renowned stock picker shared the 15 common stocks that had the largest market value at the end of 2020.

Berkshire owns large stakes in companies like AbbVie (ABBV), American Express (AXP), Apple (AAPL), Bank of America (BAC), Bank of New York Mellon (BK), BYD Co., Charter Communications (CHTR), Coca-Cola (KO), Chevron (CVX), General Motors (GM), Itochu, Merck (MRK), Moody's Corp (MCO), U.S. Bancorp (USB), and Verizon (VZ). (Yahoo Finance is owned by Verizon.)

Buffett excluded Kraft-Heinz (KHC) from the list of top 15 holdings because it's held using a different accounting method. Berkshire owns 325,442,152 sharers, or 26.6% of the outstanding stock, in the cheese and ketchup manufacturer. He noted that the GAAP figure for Kraft-Heinz was $13.3 billion on Dec. 31, while the market value on the date was $11.3 billion.

Some of the investments have been huge home runs. For example, Berkshire’s cost to purchase 151.61 million shares of American Express was $1.28 billion, and that investment was worth $18.33 billion at year-end. Berkshire’s $31 billion investment in 907.56 million Apple shares was worth $120.4 billion at the end of 2020, while its $232 million investment in 225 million shares of Chinese electric bus-maker BYD was worth $5.89 billion.

Berkshire Hathaway is a sprawling conglomerate with a massive portfolio of stocks and ownership of businesses across sectors and industries such as insurance, manufacturing, services, retailing, and energy. Some of the companies Berkshire owns include Benjamin Moore, Brooks, Clayton Homes, Duracell, GEICO, Dairy Queen, Nebraska Furniture Mart, and See’s Candies, to mention a few.

Last year, Berkshire earned $42.5 billion on a GAAP basis, consisting of $21.9 billion in operating earnings, $4.9 billion in realized capital gains, $26.7 billion in net unrealized gains in stocks held, and $11 billion loss from a write-down in some of the subsidiary businesses, mostly from a "mistake" Buffett made in 2016 when he “paid too much” for Precision Castparts, an aerospace metal components and products manufacturer.

Buffett emphasized that the operating earnings “are what count most,” even when they’re not the largest contributor to the net results. Because of an accounting rule change a few years ago, swings in the value of Berkshire stock portfolio have made GAAP net earnings much more volatile.

Regarding the realized and unrealized capital gains or losses from the stock investments, Buffett pointed out those components “fluctuate capriciously from year to year, reflecting swings in the stock market.” To be sure, Buffett and his long-time partner, Charlie Munger, expect the capital gains from the stock investments to be “substantial.”

The famed investing duo also views the stock portfolio “as a collection of businesses.”

“We don’t control the operations of those companies, but we do share proportionately in their long-term prosperity," Buffett wrote. "From an accounting standpoint, however, our portion of their earnings is not included in Berkshire’s income. Instead, only what these investees pay us in dividends is recorded on our books. Under GAAP, the huge sums that investees retain on our behalf become invisible."

He added that those unrecorded retained earnings are usually building “lots of value” for Berkshire when those companies use those funds to grow their businesses and pay off debt and buyback stock.

“As we pointed out in these pages last year, retained earnings have propelled American business throughout our country’s history. What worked for Carnegie and Rockefeller has, over the years, worked its magic for millions of shareholders as well,” Buffett wrote.

While some investments will disappoint with their retained earnings, others will “will over-deliver, a few spectacularly.”

“In aggregate, we expect our share of the huge pile of earnings retained by Berkshire’s non-controlled businesses (what others would label our equity portfolio) to eventually deliver us an equal or greater amount of capital gains. Over our 56-year tenure, that expectation has been met,” Buffett added.

This article was originally published By Julia La Roche, finance.yahoo.com.