Welcome to the AI gold rush!

We are currently experiencing another gold rush in AI. Billions are being invested in

AI

startups across every imaginable industry and business function. Google, Amazon,

Microsoft and IBM are in a heavyweight fight investing over $20 billion in AI in 2016.

Corporates are scrambling to ensure they realise the productivity benefits of AI ahead

of their competitors while looking over their shoulders at the startups. China is

putting its considerable weight behind AI and the European Union is talking about a

$22 billion AI investment as it fears losing ground to China and the US.

AI is everywhere. From the 3.5 billion daily searches on Google to the new Apple iPhone

X that uses facial recognition to Amazon Alexa that cutely answers our questions.

Media headlines tout the stories of how AI is helping doctors diagnose diseases, banks

better assess customer loan risks, farmers predict crop yields, marketers target and

retain customers, and manufacturers improve quality control. And there are think tanks

dedicated to studying the physical, cyber and political risks of AI.

AI and machine learning will become ubiquitous and woven into the

fabric of

society.

But as with any gold rush the question is who will find gold? Will it just be the

brave, the few and the large? Or can the snappy upstarts grab their nuggets? Will

those providing the picks and shovel make most of the money? And who will hit pay

dirt?

So where is the value being created with AI?

As I started thinking about who was going to make money in AI I ended up with seven

questions. Who will make money across the chip makers, platform and infrastructure providers, enabling models and algorithm providers, enterprise solution providers, industry vertical solution providers, corporate users of AI and nations?

While there are many ways to skin the cat of the AI landscape,

hopefully below provides a useful explanatory framework — a value chain of sorts. The

companies noted are representative of larger players in each category but in no way is

this list intended to be comprehensive or predictive.

1. Who’s got the best AI chips and hardware?

Even though the price of computational power has fallen exponentially, demand is rising

even faster. AI and machine learning with its massive datasets and its trillions of

vector and matrix calculations has a ferocious and insatiable appetite. Bring on the

chips.

NVIDIA’s stock is up 1500% in the past two years benefiting from the fact that their

graphical processing unit (GPU) chips that were historically used to

render beautiful

high speed flowing games graphics were perfect for machine learning. Google recently

launched its second generation of Tensor Processing Units (TPUs). And

Microsoft is

building its own Brainwave AI machine learning chips. At the same time startups such

as Graphcore, who has raised over $110M, is looking to enter the

market. Incumbents

chip providers such as IBM, Intel,

Qualcomm and AMD

are not standing

still. Even

Facebook is rumoured to be building a team to design its own AI chips. And the Chinese

are emerging as serious chip players with Cambricon Technology

announcing the first

cloud AI chip this past week.

Who made the money? Levi Strauss and Samuel Brannan didn’t mine for gold

themselves but instead made a fortune selling supplies to miners — wheelbarrows,

tents, jeans, picks and shovels, etc.

What is clear is that the cost of designing and manufacturing chips then sustaining a

position as a global chip leader is very high. It requires extremely deep pockets and

a world class team of silicon and software engineers. This means that there will be

very few new winners. Just like the gold rush days those that provide the cheapest and

most widely used

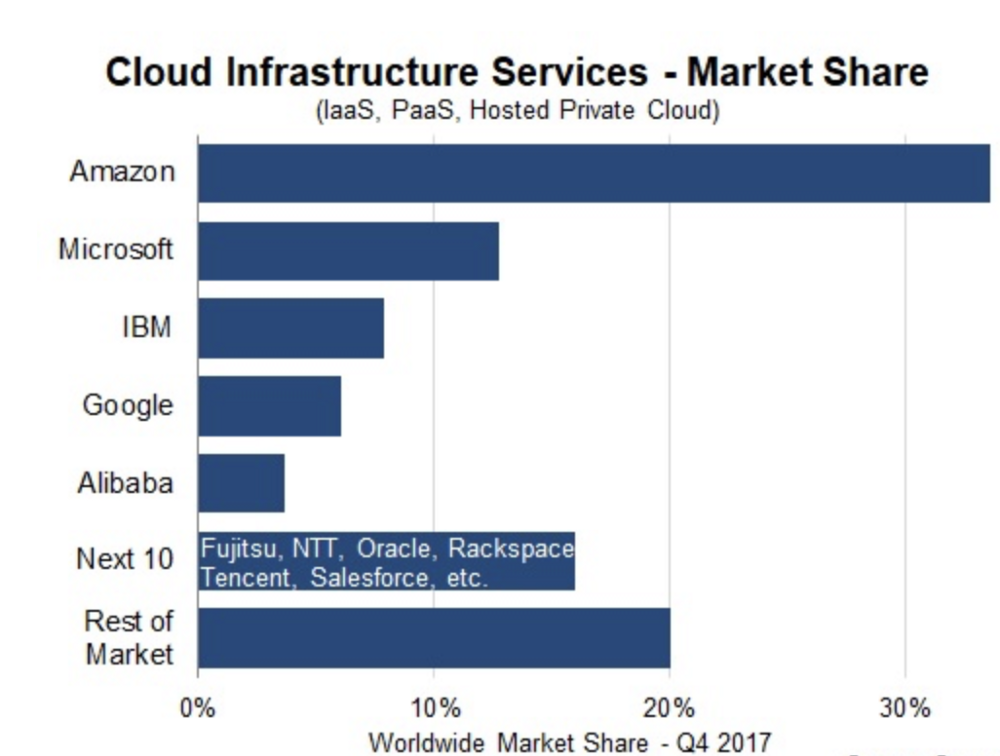

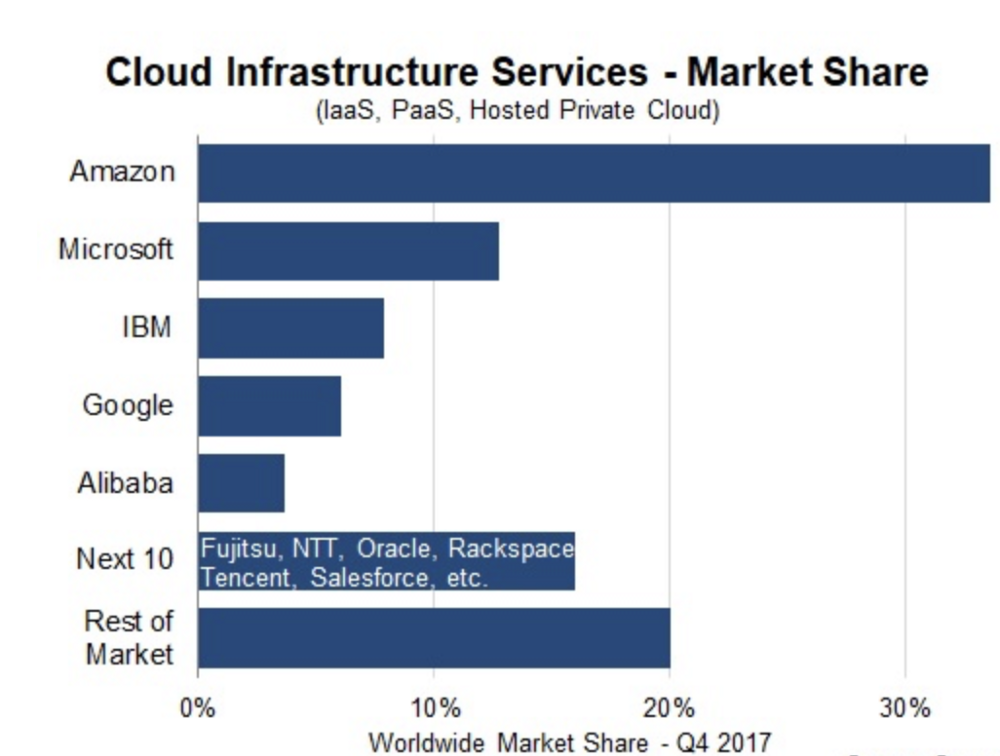

2. Who’s got the best infrastructure and platform clouds for AI?

The AI race is now also taking place in the cloud. Amazon realised early that startups

would much rather rent computers and software than buy it. And so it launched Amazon

Web Services (AWS) in 2006. Today AI is demanding so much compute power that companies

are increasingly turning to the cloud to rent hardware through Infrastructure as a

Service (IaaS) and Platform as a Service (PaaS)

offerings.

The fight is on among the tech giants. Microsoft is offering their

hybrid public and private

Azure cloud service that allegedly has over one million

computers. And in the past few weeks they announced that their

Brainwave

hardware solutions dramatically accelerate

machine learning with their own Bing search engine performance improving by a factor

of ten. Google is rushing to play catchup with its own GoogleCloud

offering. And we are seeing the Chinese Alibaba

starting to take global share.

Amazon — Microsoft — Google and IBM are going to continue to duke this one out. And

watch out for the massively scaled cloud players from China. The big picks and shovels

guys will win again.

3. Who’s got the best enabling algorithms?

Today Google is the world’s largest AI company attracting the best AI minds, spending

small country size GDP budgets on R&D, and sitting on the best datasets gleamed from

the billions of users of their services. AI is powering Google’s search, autonomous

vehicles, speech recognition, intelligent reasoning, massive search and even its own

work on drug discovery and disease diangosis.

And the incredible AI machine learning software and algorithms that

are powering all of

Google’s AI activity — TensorFlow — is now being given away for free.

Yes for free!

TensorFlow is now an open source software project available to the world. And why are

they doing this? As Jeff Dean, head of Google Brain, recently said there are

20

million

organisations in the world that could benefit from machine learning today.

If

millions of companies use this best in class free AI software then they are likely to

need lots of computing power. And who is better served to offer that? Well Google

Cloud is of course optimised for TensorFlow and related AI services. And once you

become reliant on their software and their cloud you become a very

sticky customer for

many years to come. No wonder it is a brutal race for global AI algorithm dominance

with Amazon — Microsoft — IBM also offering their own cheap or free AI software

services.

We are also seeing a fight for not only machine learning algorithms but

cognitive algorithms that offer services for conversational agents

and bots,

speech, natural

language processing (NLP) and semantics, vision, and enhanced core algorithms. One

startup in this increasingly contested space is Clarifai who provides

advanced image

recognition systems for businesses to detect near-duplicates and visual searches. It

has raised nearly $40M over the past three years. The market for vision related

algorithms and services is estimated to be a cumulative $8 billion in revenue between

2016 and 2025

The giants are not standing still. IBM, for example, is offering its

Watson cognitive

products and services

. They have twenty or so APIs for chatbots, vision, speech,

language, knowledge management and empathy that can be simply be plugged into

corporate software to create AI enabled applications. Cognitive APIs are everywhere.

KDnuggets lists here over 50 of the top cognitive services from the

giants and

startups. These services are being put into the cloud as AI as a Service

(AIaaS) to

make them more accessible. Just recently Microsoft’s CEO Satya Nadella claimed that a

million developers are using their AI APIs, services and tools for

building AI-powered

apps and nearly 300,000 developers are using their tools for

chatbots. I wouldn’t want

to be a startup competing with these Goliaths.

The winners in this space are likely to favour the heavyweights again. They can hire

the best research and engineering talent, spend the most money, and have access to the

largest datasets. To flourish startups are going to have to be really well funded,

supported by leading researchers with a whole battery of IP patents and published

papers, deep domain expertise, and have access to quality datasets. And they should

have excellent navigational skills to sail ahead of the giants or sail different

races. There will many startup casualties, but those that can scale will find

themselves as global enterprises or quickly acquired by the heavyweights. And even if

a startup has not found a path to commercialisation, then they could become

acquihires

(companies bought for their talent) if they are working on enabling AI algorithms with

a strong research oriented team. We saw this in 2014 when DeepMind, a

two year old

London based comGooglehat developed unique reinforcement machine

learning algorithms,

was acquired by Google for $400M.

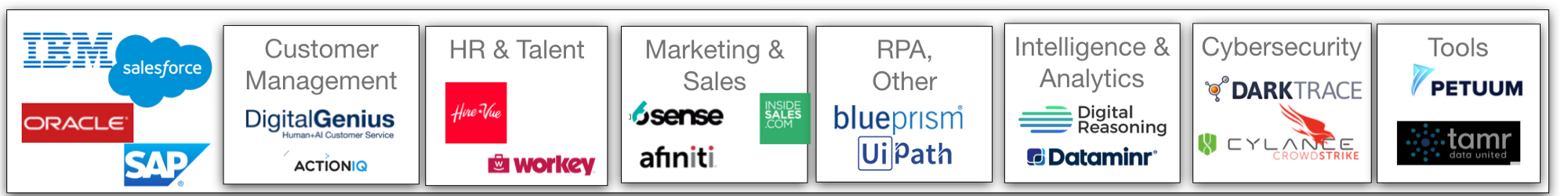

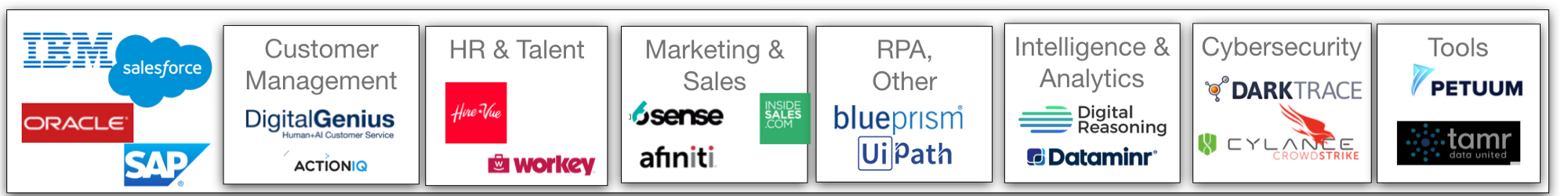

4. Who has the best enterprise solutions?

Enterprise software has been dominated by giants such as Salesforce,

IBM, Oracle and

SAP. They all recognise that AI is a tool that needs to be integrated into their

enterprise offerings. But many startups are rushing to become the next generation of

enterprise services filling in gaps where the incumbents don’t currently tread or even

attempting to disrupt them.

We analysed over two hundred use cases in the enterprise space ranging

from customer

management to marketing to cybersecurity to intelligence to HR to the hot area of

Cognitive Robotic Process Automation (RPA). The enterprise field is much more

open

than previous spaces with a veritable medley of startups providing point solutions for

these use cases. Today there are over 200 AI powered companies just in the recruitment

space, many of them AI startups. Cybersecurity leader DarkTrace and RPA leader

UiPathhave war chests in the $100 millions. The incumbents also want to make sure

their ecosystems stay on the forefront and are investing in startups that enhance

their offering. Salesforce has invested in Digital Genius a customer

management

solution and similarly Unbable that offers enterprise translation

services. Incumbents

also often have more pressing problems. SAP, for example, is rushing to play catchup

in offering a cloud solution, let alone catchup in AI. We are also seeing tools

providers trying to simplify the tasks required to create, deploy and manage AI

services in the enterprise. Machine learning training, for example, is a messy

business where 80% of time can be spent on data wrangling. And an inordPetuumamount of

time is spent on testing and tuning of what is called hyperparameters.

Petuum, a tools

provider based in Pittsburgh in the US, has raised over $100M to help accelerate and

optimise the deployment of machine learning models.

Many of these enterprise startup providers can have a healthy future if they quickly

demonstrate that they are solving and scaling solutions to meet real world enterprise

needs. But as always happens in software gold rushes there will be a handful of

winners in each category. And for those AI enterprise category winners they are likely

to be snapped up, along with the best in-class tool providers, by the giants if they

look too threatening.

5. Who’s got the best vertical solutions?

AI is driving a race for the best vertical industry solutions. There are a wealth of

new AI powered startups providing solutions to corporate use cases in the healthcare,

financial services, agriculture, automative, legal and industrial sectors. And many

startups are taking the ambitious path to disrupt the incumbent corporate players by

offering a service directly to the same customers.

It is clear that many startups are providing valuable point solutions

and can succeed

if they have access to (1) large and proprietary data training sets,

(2) domain knowledge that gives them deep insights into the

opportunities within a sector, (3) a

deep pool of talent around applied AI and (4) deep pockets of

capital

to fund rapid

growth. Those startups that are doing well generally speak the corporate commercial

language of customers, business efficiency and ROI in the form of well developed

go-to-market plans.

For example, ZestFinance has raised nearly $300M to help improve

credit decision making

that will provide fair and transparent credit to everyone. They claim they have the

world’s best data scientists. But they would, wouldn’t they? For those startups that

are lookiAffirmdisrupt existing corporate players they need really

deep pockets. For

example, Affirm, that offers loans to consumers at the point of sale, has raised over

$700M. These companies quickly need to create a defensible moat to ensure they remain

competitive. This can come from data network effects where more data

begets better AI

based services and products that gets more revenue and customers that gets more data.

And so the flywheel effect continues.

6. Which corporates will capture the value of AI?

And while corporates might look to new vendors in their industry for AI solutions that

could enhance their top and bottom line, they are not going to sit back and let

upstarts muscle in on their customers. And they are not going to sit still and let

their corporate competitors gain the first advantage through AI. There is currently a

massive race for corporate innovation. Large companies have their own venture groups

investing in startups, running accelerators and building their own startups to ensure

that they are leaders in AI driven innovation.

Large corporates are in a strong position against the startups and smaller companies

due to their data assets. Data is the fuel for AI and machine learning. Who is better

placed to take advantage of AI than the insurance company that has reams of historic

data on underwriting claims? The financial services company that knows everything

about consumer financial product buying behaviour? Or the search company that sees

more user searches for information than any other?

Corporates large and small are well positioned to extract value from AI. In fact

Gartner research predicts AI-derived business value is projected to reach up to $3.9

trillion by 2022. There are hundreds if not thousands of valuable use cases that AI

can addresses across organisations. Corporates can improve their customer experience,

save costs, lower prices, drive revenues and sell better products and services powered

by AI. AI will help the big get bigger often at the expense of smaller companies. But

they will need to demonstrate strong visionary leadership, an ability to execute, and

a tolerance for not always getting technology enabled projects right on the first try.

7. Which countries will see the most benefits from AI?

Countries are also also in a battle for AI supremacy. China has not been shy about its

call to arms around AI. It is investing massively in growing technical talent and

developing startups. Its more lax regulatory environment, especially in data privacy,

helps China lead in AI sectors such as security and facial recognition. Just recently

there was an example of Chinese police picking out one most wanted face in a crowd of

50,000 at a music concert. And SenseTime Group Ltd, that analyses faces and images on

a massive scale, reported it raised $600M becoming the most valuable global AI

startup. The Chinese point out that their mobile market is 3x the size of the US and

there are 50x more mobile payments taking place — this is a massive data advantage.

The European focus on data privacy regulation could put them at a disadvantage in

certain areas of AI even if the Union is talking about a $22B investment in AI.

The UK, Germany, France and Japan have all made recent announcements about their nation

state AI strategies. For example, President Macron said the French government will

spend $1.85 billion over the next five years to support the AI ecosystem including the

creation of large public datasets. Companies such as Google’s DeepMind and Samsung

have committed to open new Paris labs and Fujitsu is expanding its Paris research

centre. The British just announced a $1.4 billion push into AI including funding of

1000 AI PhDs. But while nations are investing in AI talent and the ecosystem, the

question is who will really capture the value. Will France and the UK simply be

subsidising PhDs who will be hired by Google? And while payroll and income taxes will

be healthy on those six figure machine learning salaries, the bulk of the economic

value created could be with this American company, its shareholders, and the smiling

American Treasury.

AI will increase productivity and wealth in companies and countries. But how will that

wealth be distributed when the headlines suggest that 30 to 40% of our jobs will be

taken by the machines? Economists can point to lessons from hundreds of years of

increasing technology automation. Will there be net job creation or net job loss? The

public debate often cites Geoffrey Hinton, the godfather of machine learning, who

suggested radiologists will lose their jobs by the dozen as machines diagnose diseases

from medical images. But then we can look to the Chinese who are using AI to assist

radiologists in managing the overwhelming demand to review 1.4 billion CT scans

annually for lung cancer. The result is not job losses but an expanded market with

more efficient and accurate diagnosis. However there is likely to be a period of

upheaval when much of the value will go to those few companies and countries that

control AI technology and data. And lower skilled countries whose wealth depends on

jobs that are targets of AI automation will likely suffer. AI will favour the large

and the technologically skilled.

So what does this all mean?

In examining the landscape of AI it has became clear that we are now entering a truly

golden era for AI. And there are few key themes appearing as to where the economic

value will migrate:

- The global technology giants are the picks and

<shovels

shovels of this

gold rush —

powering AI for whoever whats to rush in. Google-Amazon-Microsoft and IBM are

in

arms race for leadership in AI. They are slugging it out to offer the best

chips,

cloud and AI algorithms and

services. And

coming up behind

are the Chinese

tech

giants Alibaba and Baidu. Few startups are going to outspend, outsmart or

offer

low prices that Microsoft on what is increasingly commodity

cloud computing or

build a better AI chip than Google’s Tensor Processing Unit or build better

object

recognition cognitive algorithms than Amazon.

- AI startups are flocking to offer cognitive algorithms,

enterprise solutions and

deep industry vertical solutions. To prosper startups will need to have access to

unique data sets, deep domain knowledge, deep

pockets and an

ability to attract

and retain the increasingly in-demand AI talent. This is not a

case of an app in a

garage will change the world. AI startup winners will be those that

solve valuable

real-world problems, scale their go-to-market quickly and build

defensible

positions. Startups should focus on enterprise and industry solutions where there

are many high value use cases to be tackled. However startup

acquihires in the

algorithmic space will be somewhat common, for at least the next few years, as the

talent war continues. There will be many startup casualties along the way with a

handful of winners in each category as is true in any gold rush. And those winners

are likely to find themselves being offered tantalising cheques by the giants.

- Corporates are well positioned to extract substantial, some say

in the trillions

of dollars, of value from AI. AI will increasingly drive an enhanced customer

experience, help drive productivity and cost reduction through the assistance and

automation major businesses processes, and improve the competitiveness of product

and service offerings. Most value will be obtained from those companies who have

scale — the best and biggest datasets, the most customers and the largest

distribution. The bigger will likely get bigger. But this will only happen if the

corporates demonstrate strong leadership and execute with a

nimbleness that has

not typically been their calling card. The corporates that are

leading in AI

execution are once again the tech giants in Google, Facebook, Apple and Amazon who

are offering AI powered products and services that are reaching global audiences

in the billions. And corporates in industries ranging from retail to healthcare to

media are running scared as the tech giants use AI to enter and disrupt new

sectors.

- Nation states are also in an AI race. China has not been shy

about its intent to

be a world leader in AI by 2030. It believes that it has structural advantages.

While many European countries are touting their government backed commitments to

AI the risk is that they are simply going to subsidise talent for the global AI

giants and accelerate the wealth of other sovereign nations. And will strong data

privacy regulations hurt European countries innovate in AI? The wealth from AI is

likely to go to those countries and companies who control and leverage the leading

AI technology and data — think US and China. And those without will likely be

challenged as automation encroaches on increasingly lower paid jobs.

In short it looks like the AI gold rush will favour the companies and countries with

control and scale over the best AI tools and

technology, the data,

the best technical

workers, the most customers and the strongest access to capital. Those with scale will

capture the lion’s share of the economic value from AI. In some ways

‘plus ça change,

plus c’est la même chose.’

But there will also be large golden nuggets that will be

found by a few choice brave startups. But like any gold rush many startups will hit

pay dirt. And many individuals and societies will likely feel like they have not seen

the benefits of the gold rush.

This is the first part in a series of articles I intend to write on the topic of the

economics of AI. I welcome your feedback.

This article was originally published By Simon Greenman

towardsdatascience.com.